Insurance of future crops

An event is recognized as insured if it is recorded:

Features of setting the sum insured

The sum insured is set within the value of the expected harvest (calculated on the basis of the average crop yield in the farm or district over the past 3-5 years multiplied by the field area and the cost per unit of harvest)

Factors influencing the cost of insurance

The cost of insurance for each farm is calculated individually, taking into account the indicators of a particular farm, its location and experience in growing crops

Benefits of insurance in INGO

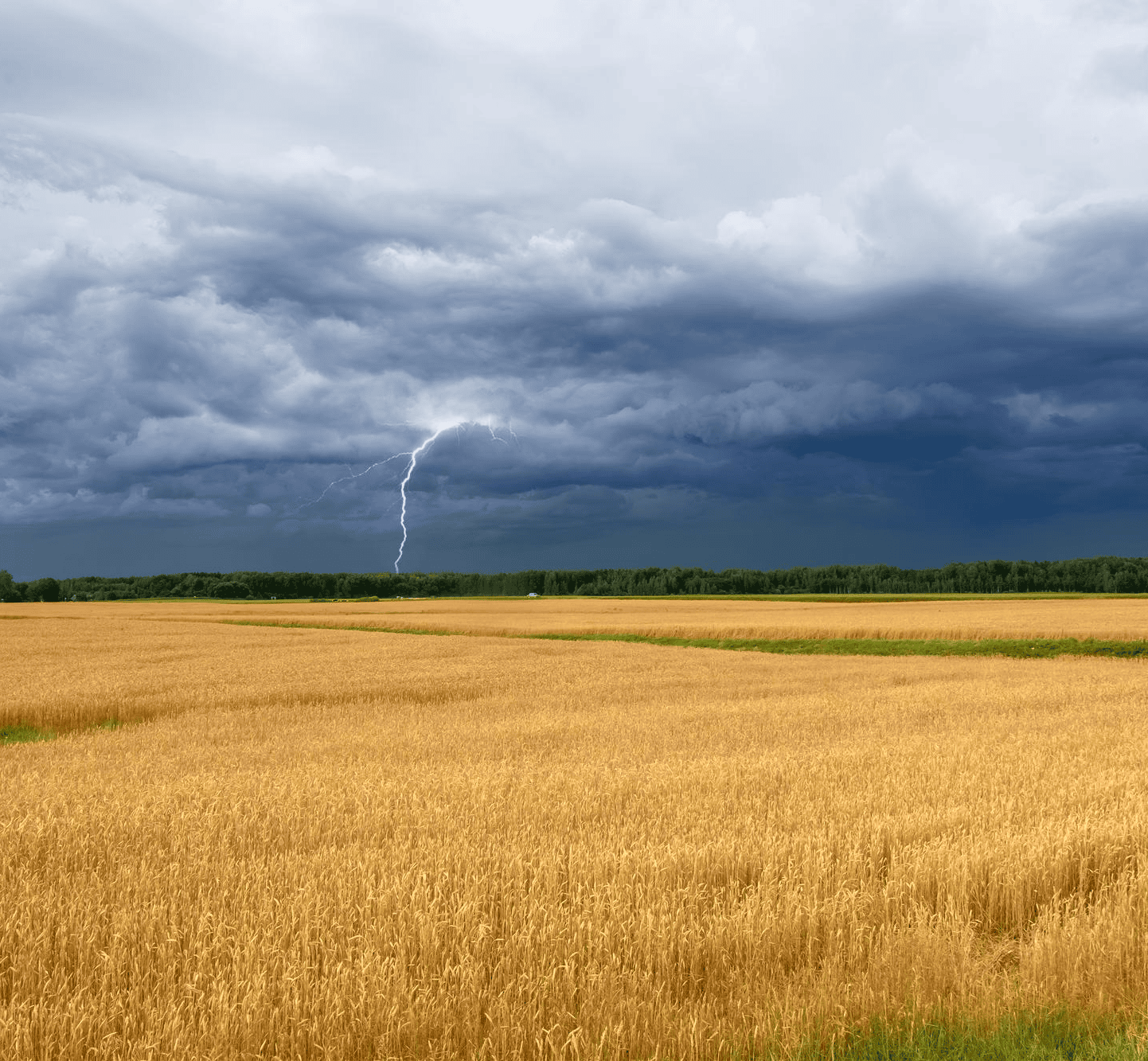

Climate change as a challenge for farmers

The biggest challenge for farmers is global climate change, which is causing severe weather conditions around the world, including in Ukraine. Even today, this requires changes in crop cultivation technology.

In such circumstances, insurance becomes one of the few effective tools for managing agricultural risks.

outlook - «Evolving»

8.12.2023

What can be insured?

Any crop that is grown industrially is eligible for insurance: wheat, rapeseed, corn, sunflower, soybeans, sugar beet, etc.

What risks can be protected against?

INGO provides insurance coverage in case of reduction or loss of crops as a result of any extraordinary natural event that may occur during the growing season.

How much does it cost to insure a future crop?

The cost of insurance is calculated individually for each farm and depends on the insurance coverage, the list of crops, the territory of cultivation, etc.

How long does it take to draw up an insurance contract?

It will take us 1-2 business days to draw up an insurance contract and make an expert assessment of the results of the inspection and analysis of documents.

How quickly can an expert come to inspect the fields?

Depending on the intensity of the insurance season, the average departure time is 3 business days.