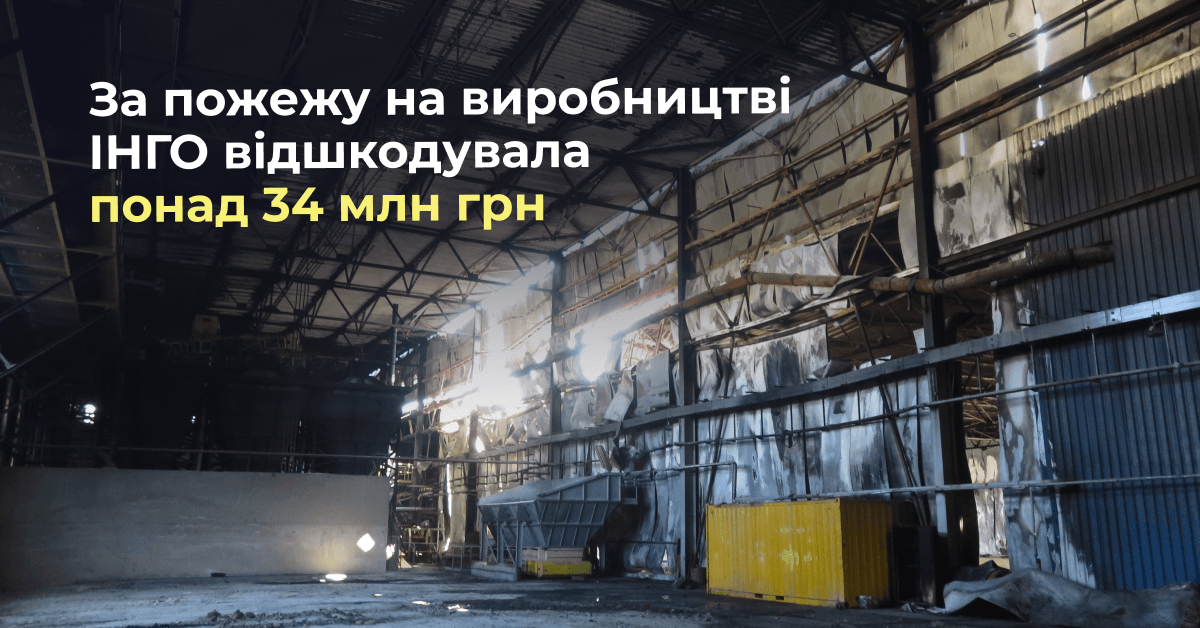

INGO Insurance Company has paid UAH 34.4 million in insurance compensation under the insurance contract with Ukrainian Ceramic Technologies LLC, a manufacturer of ceramic building blocks.

The payout follows a large-scale fire that destroyed a significant portion of the company's production facilities in the Kyiv region. The blaze damaged areas critical to operations, including preparation, molding, drying, firing, packaging, and warehousing. Key production equipment was also severely affected. An investigation determined that the fire was the result of arson committed by an unauthorized individual. The compensation was paid in April 2025.