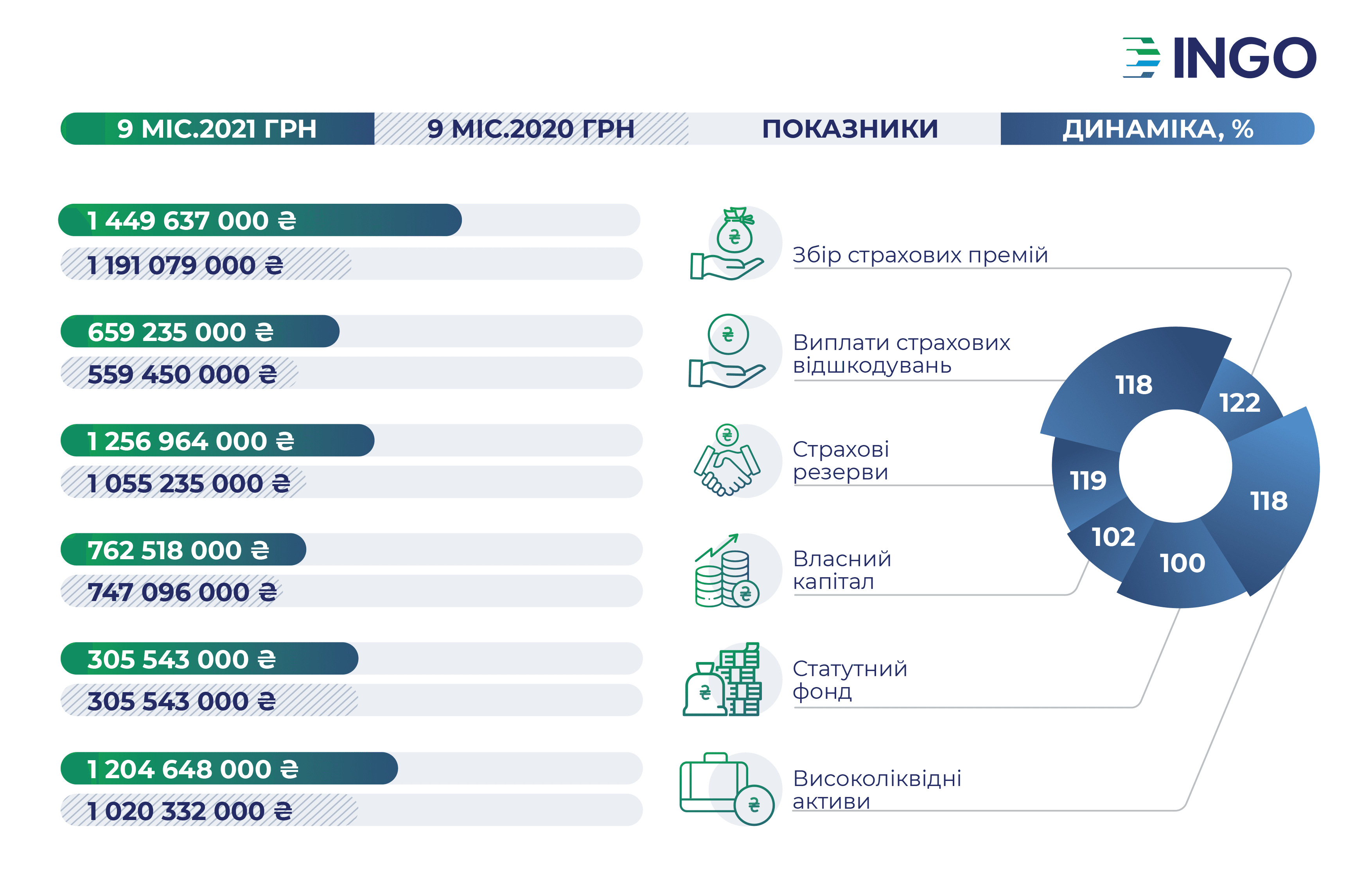

According to the results for 9 months of 2021, JSIC “INGO” collected over UAH 1,449 mln of insurance premiums. This is 22% more than the indicators of the same period last year. The company's insurance reserves amounted to UAH 1.256 billion, which is 19% higher than the indicators of the previous period.

INGO settled over 130,000 insured events and paid over UAH 659 mln to discharge its liabilities to the customers. This is 18% more than in the same period last year.

The company adheres to the criteria of the liquidity, capital adequacy, asset quality and transaction risk.

As of September 30, the value of highly liquid assets amounted to UAH 1,204,648 thousand, and the actual solvency margin exceeds the normative one by UAH 406,078 thousand and amounts to UAH 714,171 thousand.

JSIC “INGO” has over 25 years of experience in the market. The company is included in the list of the largest insurance companies in Ukraine in terms of the amount of its premiums, size of its own assets and amount of paid claims.

In June 2021, the rating agency "IBI-Rating" confirmed the long-term credit rating of JSIC "INGO" as per the national rating scale at the level of uaAA, the forecast - "in development".