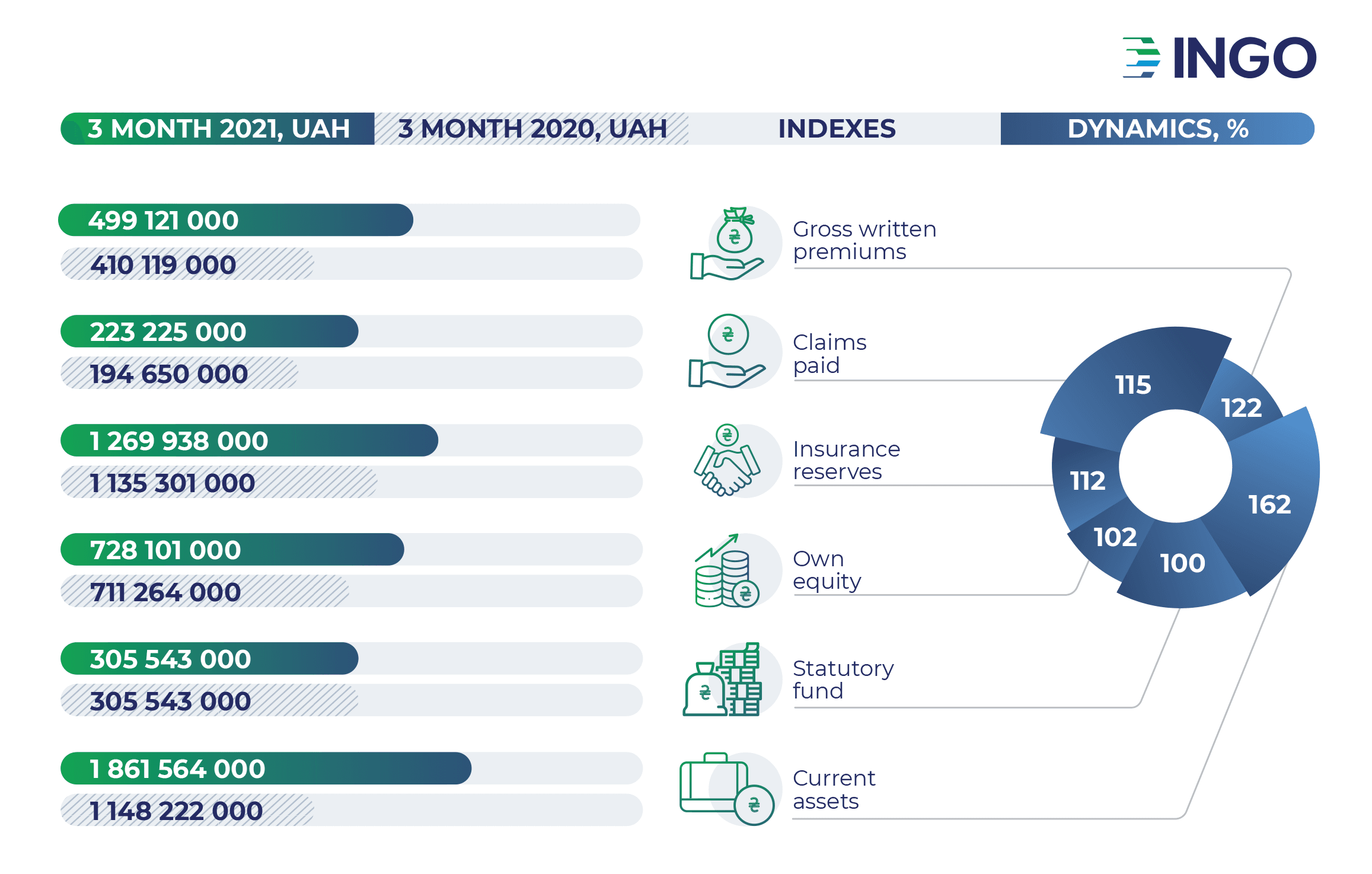

JSC “Insurance Company “INGO” collected over UAH 449 million in insurance premiums in Q1 2021, which exceeds its indicators by 22% compared to the same period of 2020.

• Gross written premiums - UAH 499,121 ths

• Claims paid - UAH 223,225 ths

• Insurance reserves - UAH 1,269,938 ths

• Own equity - UAH 728,101 ths

• Statutory fund - UAH 305,543 ths

• Current assets - UAH 1,861,564 ths

Under its liabilities to clients INGO has settled almost 50,000 insured events and paid over UAH 223 mln, which exceeds this indicator by 15% compared to the same period last year.

UAH 1.269 billion were formed in the form of insurance reserves. This amount is 12% higher than in the previous period.

The company adheres to the standards and criteria for liquidity, capital adequacy, asset quality and operational risk. The value of highly liquid assets as of March 31, 2021 is UAH 1,861,564 ths, which is 62% more than in the same period of 2020.

The actual solvency margin is UAH 682,323 ths and exceeds the normative one by UAH 402,471 ths.

JSC “Insurance Company “INGO” has over 25 years of work experience on the market. It holds 28 licenses for different classes of compulsory and voluntary insurance and is one of the largest insurance organizations of Ukraine.

In 2020, the agency “IBI-Rating” affirmed a long-term credit rating of JSIC “INGO” at uaAA according to the national rating scale, with ‘in development’ forecast.