Property insurance against war risks

What can be insured?

We provide insurance coverage for your property:

Damage or destruction of property as a result:

- Missiles and/or their fragments

- Impacts of unmanned aerial vehicles and/or their fragments

- Use of other instruments and means of war

Expanding coverage

Subject to contractual clauses, the indemnity for consequential damages may be provided for in addition:

Costs of preventing or reducing the amount of damage

Provided that due to such expenses it was possible to avoid damage to the insured property in the amount exceeding the expenses incurred

Cleaning of debris

Applies to property in the insured territory that was directly destroyed or damaged as a result of an insured event

Payment of expert fees

Necessary and reasonable fees for the services of architects, surveyors, consultants on engineering and technical issues and other expert specialists ordered for the purpose of restoration or repair of the insured property as a result of the insured event

Overtime expenses

Additional expenses incurred by the Insured in order to reduce the amount of losses, restore and/or repair the insured property damaged or destroyed as a result of the Insured Event

Benefits of insurance in INGO

A war risk insurance contract is concluded separately, regardless of whether a regular property insurance contract (Property Damage (PD)) is concluded.

In the event of a request for comprehensive insurance, two separate proposals are submitted with the terms and conditions of property insurance and war risks, and the war risks proposal is valid only simultaneously with the property insurance proposal.

The decision on each individual object is made by INGO's underwriter, taking into account, among other things, possible cumulation in the insurance territory.

outlook - "Evolving"

8.12.2023

Are there any special requirements when concluding a property insurance contract against war risks?

Thus, when entering into such agreements, certain requirements must be met, in particular:

- Provision of information on the name of the legal entity, location of the object of insurance, category of property transferred for insurance

- Providing confirmation that there have been no losses under war risks since the beginning of a full-scale invasion.

- Provide confirmation that the object has not been abandoned and is functioning as of the date of commencement of coverage.

- Breakdown of values by property category.

What is the maximum sum insured for war risks?

The maximum limit of indemnity for one risk and for the contract as a whole is UAH 20 million.

Are there any restrictions on the insurance territory?

Yes. Objects located at a distance of less than 100 km from the occupied territories and from the border with the Russian Federation are not eligible for insurance.

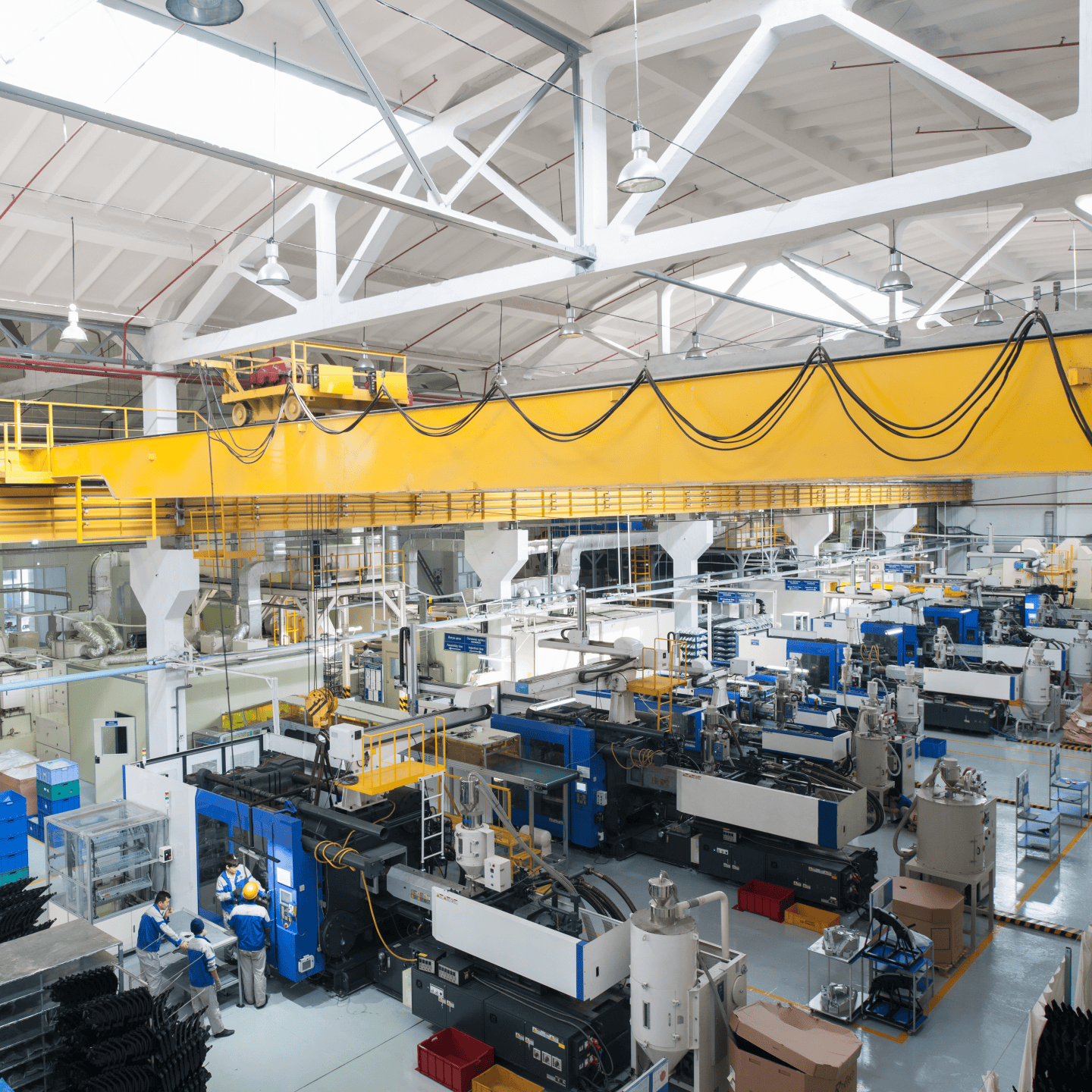

What objects are not eligible for insurance?

The following objects are not eligible for war risks insurance:

- Power plants and other critical infrastructure (ports, airports, bridges, overpasses, dams, etc.)

- Port infrastructure, including any other property located on the territory of ports

- Facilities involved in the production, transportation (pipelines) and storage of oil, gas, and petroleum products

- Agricultural machinery, construction and other special equipment

- Vehicles, aircraft and ships

What affects the cost of insurance?

Factors affecting the tariff:

- proximity to critical infrastructure facilities,

- percentage of glazing,

- total value of the property,

- availability of a property insurance contract for Property Damage (PD)

What is the cost of insuring property with war risks?

The approximate annual rate is 0.8%-1.2% of the sum insured.