Insurance of machinery and equipment

«All risks»

Coverage on «all risks» basis covers all cases of damage or destruction of property, except for the exclusions specifically stipulated in the insurance contract.

«Named perils»

Coverage against risks specified in the insurance contract, the most common of which are:

- Unforeseen breakdowns or defects

- Errors, negligence or carelessness of personnel

- Breakage of cables and chains, falling of insured objects and their impact on other objects

- Overloading, overheating, vibration, jamming, clogging of the mechanism; foreign objects, pressure changes, «mechanism fatigue»

- Explosion of steam boilers, internal combustion engines and other energy sources

- Breakdowns or malfunctions of devices

- Fire risks

- Water damage

- Natural disasters

- Unlawful acts of third parties, including theft, robbery and assault

- Production equipment, machinery and tools

- Compressor units

- Machine tools

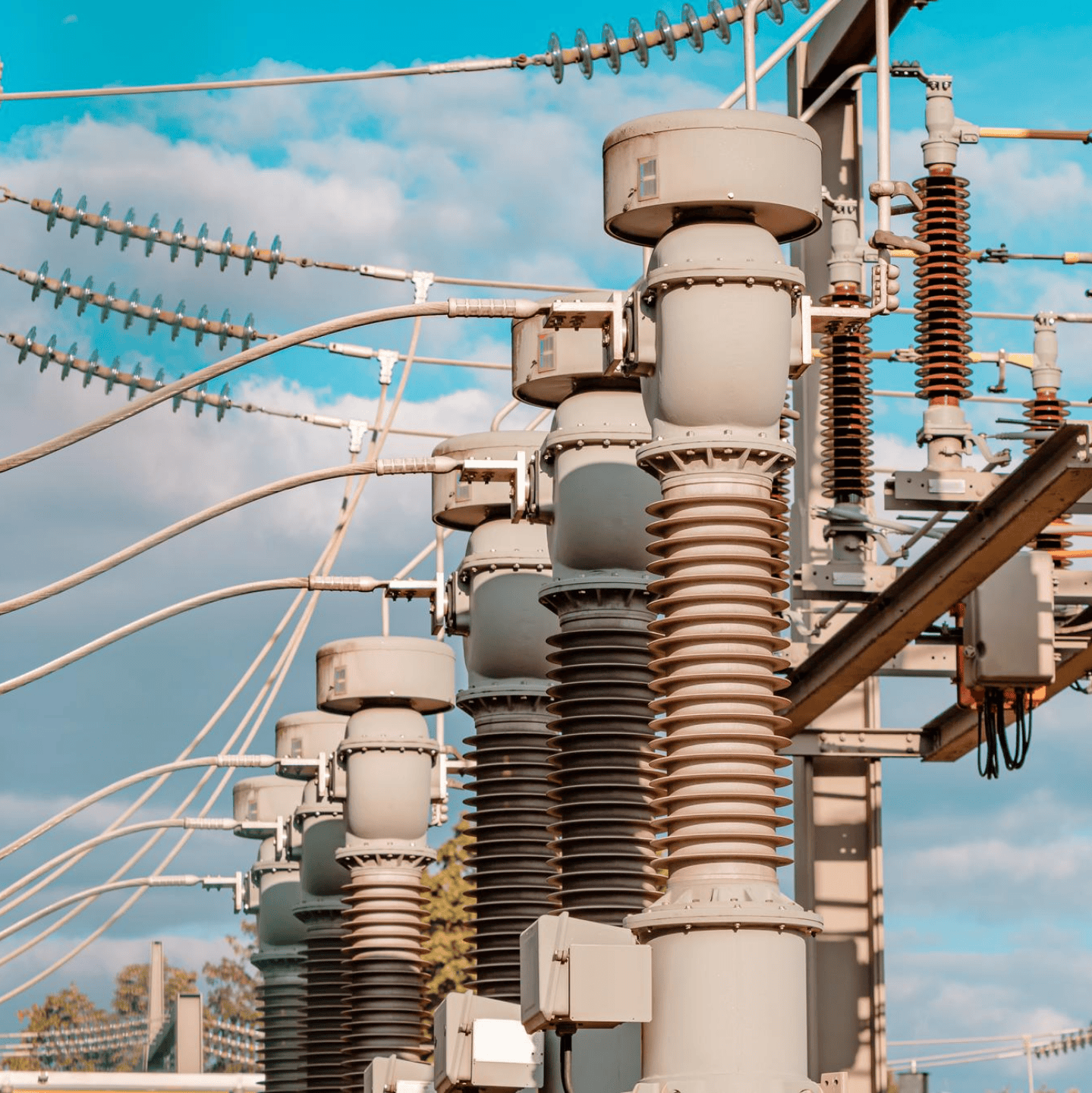

- Gas or steam turbines, steam boilers, boilers, industrial transformers, generators, etc.

Benefits of insurance in INGO

Additional information

Additional coverage is available upon request (the list is not exhaustive):

- sudden power outage from power supply systems

- failure of air conditioning systems

- ordinary theft (without breaking and entering)

- use of the insured equipment for experimental or research purposes

- costs of cleaning the territory after the insured event

- losses and expenses to prevent the destruction of equipment

outlook - "Evolving"

29.03.2024

How is the sum insured determined?

The basis for determining the sum insured shall be the actual or replacement cost of the insured machinery and equipment. However, another basis may be determined by agreement of the parties.

For how long can I conclude an insurance contract?

The standard term of the insurance contract is 1 year, but another term may be determined by agreement of the parties.

Is it possible to attribute the insurance premium to the gross costs of the enterprise?

Thus, the costs of machinery and equipment insurance are fully included in its gross costs.