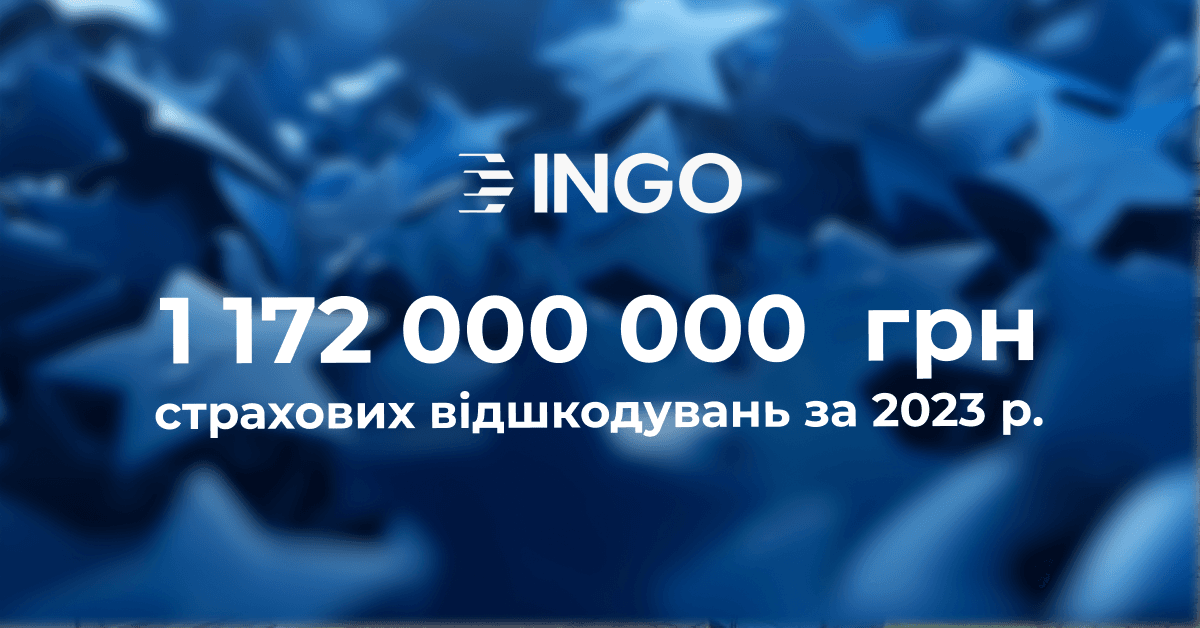

In 2023, INGO Insurance Company indemnified its clients for losses amounting to over UAH 1 billion 172 million. This is 74% more than in 2022. Premiums collected also increased by 50%.

According to the results of 2023, the company recorded a significant increase in collected insurance premiums. Compared to 2022, INGO increased this figure by 50%. A total of UAH 2 billion 674 million in premiums was raised, of which over UAH 1.9 billion came from legal entities.

In 2023, over 640 thousand insurance contracts were issued. The company's specialists received more than 458 thousand calls to the contact center. More than 152 thousand insured events were settled, for which the indemnities amounted to UAH 1 billion 172 million.