Amid the reduction of general business activities due to the lockdown measures, “Insurance Company “INGO” has increased its amount of earned premiums by 2.3% in Q2 2020.

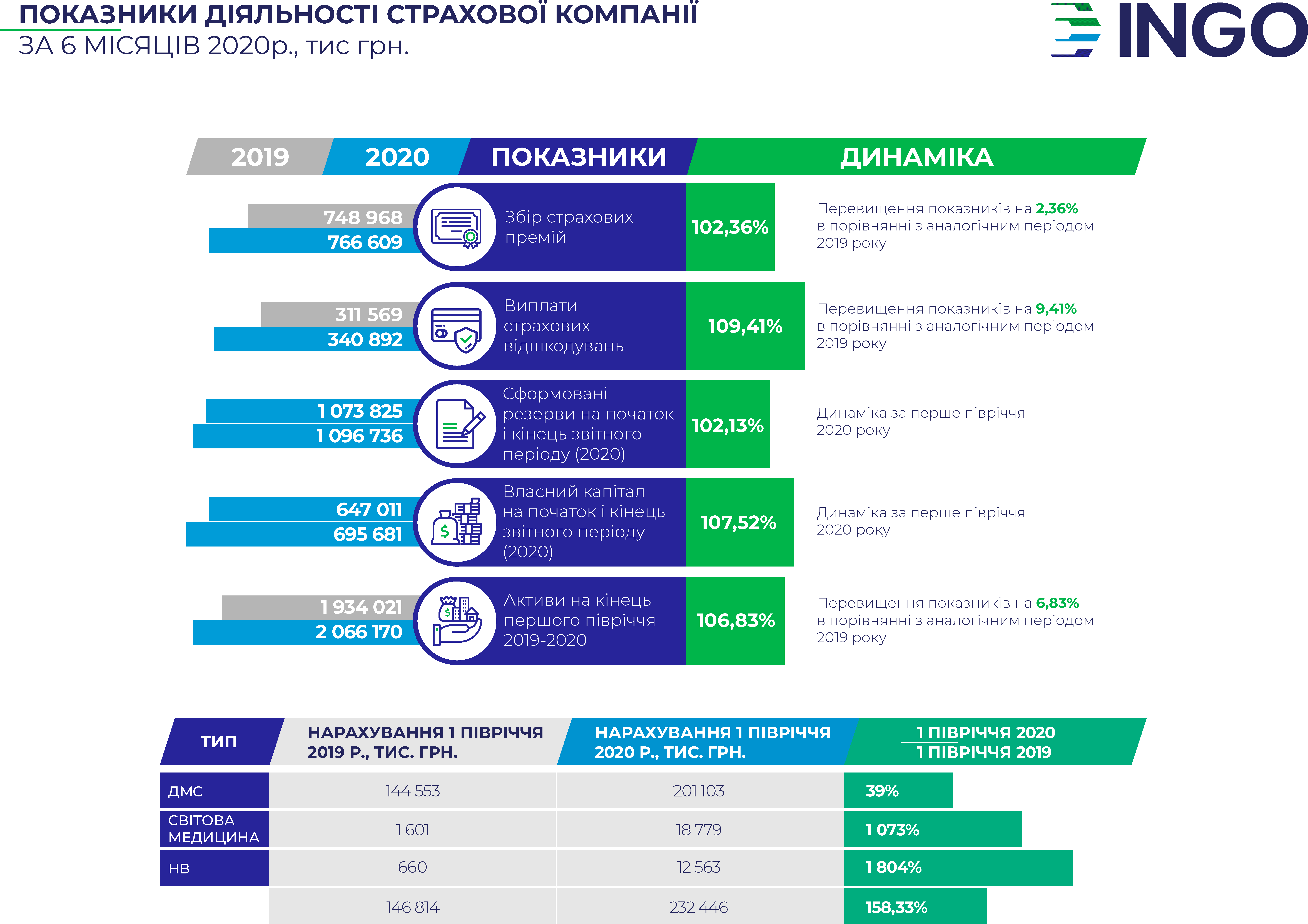

Based on Q2 2020 results, the JSC “Insurance Company “INGO” collected over UAH 766 mln of insurance premiums, which exceeds its indicators by 2.3% compared to the same period of 2019.

Composition of collection:

- Motor insurance – over UAH 341 mln

- Personal insurance – over UAH 237 mln

- Comprehensive insurance (property and liability) – over UAH 155 mln

- Specialty lines – almost UAH 30 mln

- Other classes – over UAH 2.7 mln

Among other things, it is worth noting that the high dynamics of growth of annual demand for health insurance remains. The current situation with COVID-19 only strengthened the significance of health protection, so the insurance premiums and indemnities in VHI constantly increase even amidst the “lockdown” economy. Each month, the sales volume increases by 20-25% compared to previous months, up to 40% - compared to the last year.

The decline in demand in the corporate sector of motor insurance started in late March and peaked in April 2020. (-45% compared to the same period of 2019). However, in May and June, the deferred demand activated and the CASCO results renewed to 2019 level. In CMTPLI sector, there was no decline in business.

Taking into account the implementation of lockdown measures and border crossing restrictions, the sales of ‘Green Card’ insurance contracts and overseas travel insurance significantly dropped.

Due to the legislative amendments on the alternative energy, the volume of construction of new solar power and wind power plants substantially decrease. The development of the branch which was the driver of growth in property insurance in 2019, actually stopped. At the same time, a marked increase of infrastructure building (roads, bridges) was observed.

Under its liabilities to clients for 6 months of 2020, “Insurance Company “INGO” paid over UAH 340 mln (+9.4%) and settled over 179 ths insured events. The relatively low dynamics of paid claims is explained by the reduction of number of insured events in March-April. During the first month of the lockdown, in April the lowest frequency of occurrence of insured events in motor insurance (CASCO, CMTPLI) for the last 10 years was observed. The made insurance reserves as of 30/06/2020 are over UAH 1,096,736 ths.

The company complies with all regulations and criteria for liquidity, capital adequacy, asset quality and risk exposure of operations. The net asset value as of 31/06/2020 is UAH 695,681 ths. The excess of net assets over amount of authorized capital is UAH 390,138 ths and complies with legislative requirements. The actual solvency margin is UAH 652,964 ths, which exceeds the normative solvency margin by UAH 403,603 ths.

***

For reference:

JSC “Insurance Company “INGO” has over 25 years of work experience on the market. Since 2017 the Ukrainian business group DCH of Oleksandr Yarovslavskyi has become the major shareholder of the company. The company is one of the largest insurance organizations of Ukraine in terms of the amount of premiums, value of its own assets and amounts of paid indemnities. It holds 29 licenses for different classes of compulsory and voluntary insurance and provides insurance services to corporate and retail clients. INGO is a full member of Motor (Transport) Insurance Bureau of Ukraine (MTIBU), member of the American Chamber of Commerce (ACC), European Business Association (EBA) and International Chamber of Commerce (ICC). On 04/06/2020, the agency “IBI-Rating” affirmed a long-term credit rating of JSIC “INGO” (JSIC “INGO Ukraine”) at uaAA according to the national rating scale, with ‘in development’ forecast.