Structure:

- Transport insurance - over UAH 167 million

- Personal insurance - over UAH 145.3 million

- Comprehensive insurance (property and liability) - over UAH 69.9 million

- Special lines - over UAH 26.7 million

- Other species - over UAH 1.1 million

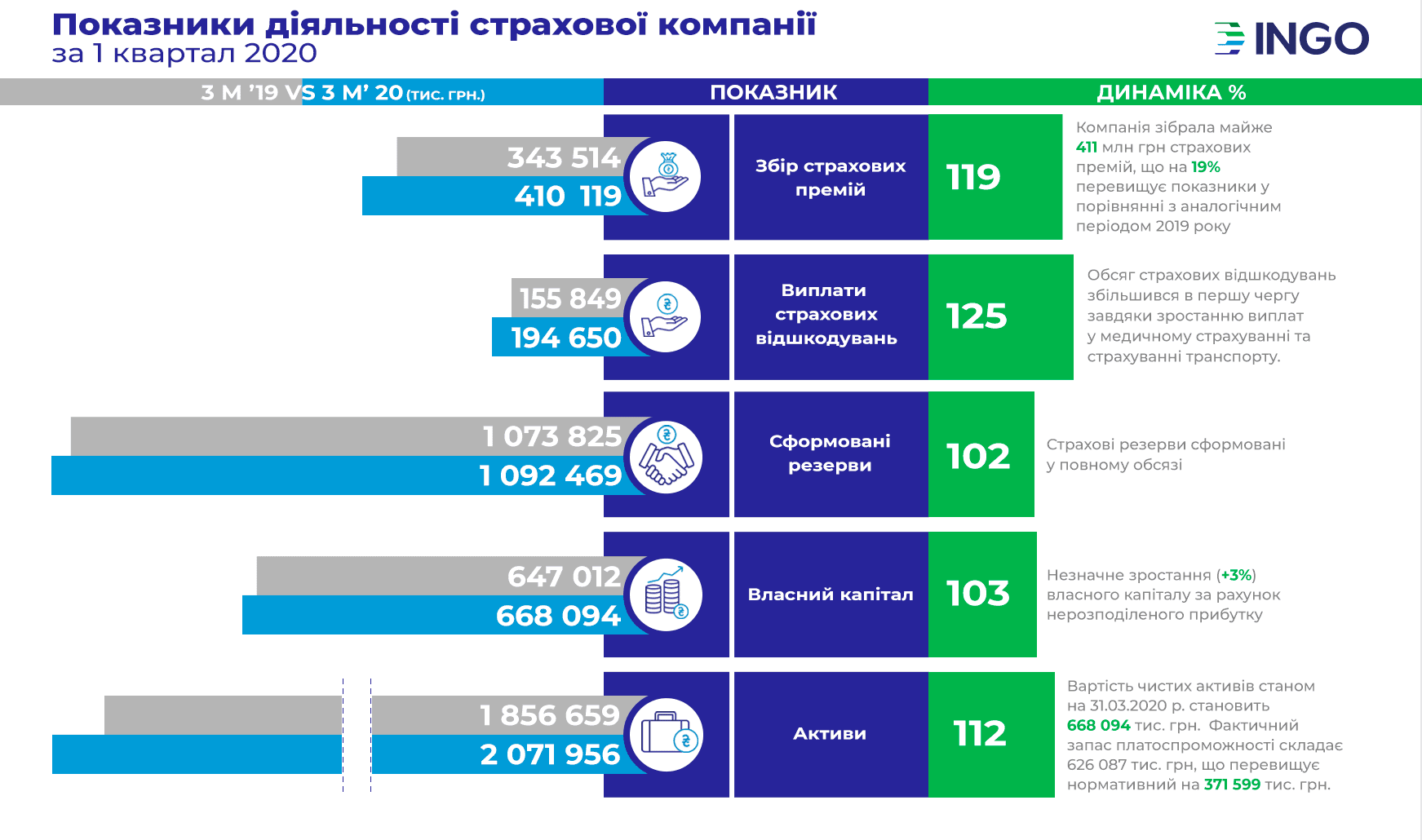

The company adheres to regulations and criteria regarding liquidity, capital adequacy, asset quality and risk of operations. The value of net assets as of March 31, 2020 is UAH 668,094 thousand. The excess of net assets over the amount of authorized capital meets the requirements of the legislation and amounts to UAH 362,551 thousand. The actual solvency margin is UAH 626,087 thousand, which exceeds the normative one by UAH 371,599 thousand.

In 32020, INGO Insurance Company paid over UAH 194 million (+ 25%) and settled more than 46,500 insurance events for its liabilities to customers. The formed insurance reserves as of March 30, 2020 amount to over UAH 1,092 million. The company continues to provide insurance claims on a full-time basis.

According to Chairman of the Board Igor Gordienko , taking into account the experience of previous crisis periods, the company has developed several scenarios for the anti-crisis plan, according to which costs will be optimized. In general, the company's operating efficiency has increased at the moment. 75 percent of employees work remotely, another 25 percent - in the company's offices, maintaining the technical infrastructure and critical regulations. Communications with customers, contractors, partners are maintained remotely. Most divisions of the company work in the same mode. As a result, domestic cashless and paperless projects have accelerated and the level of non-cash transactions and electronic document management, which was expected only at the end of the year, has already been reached