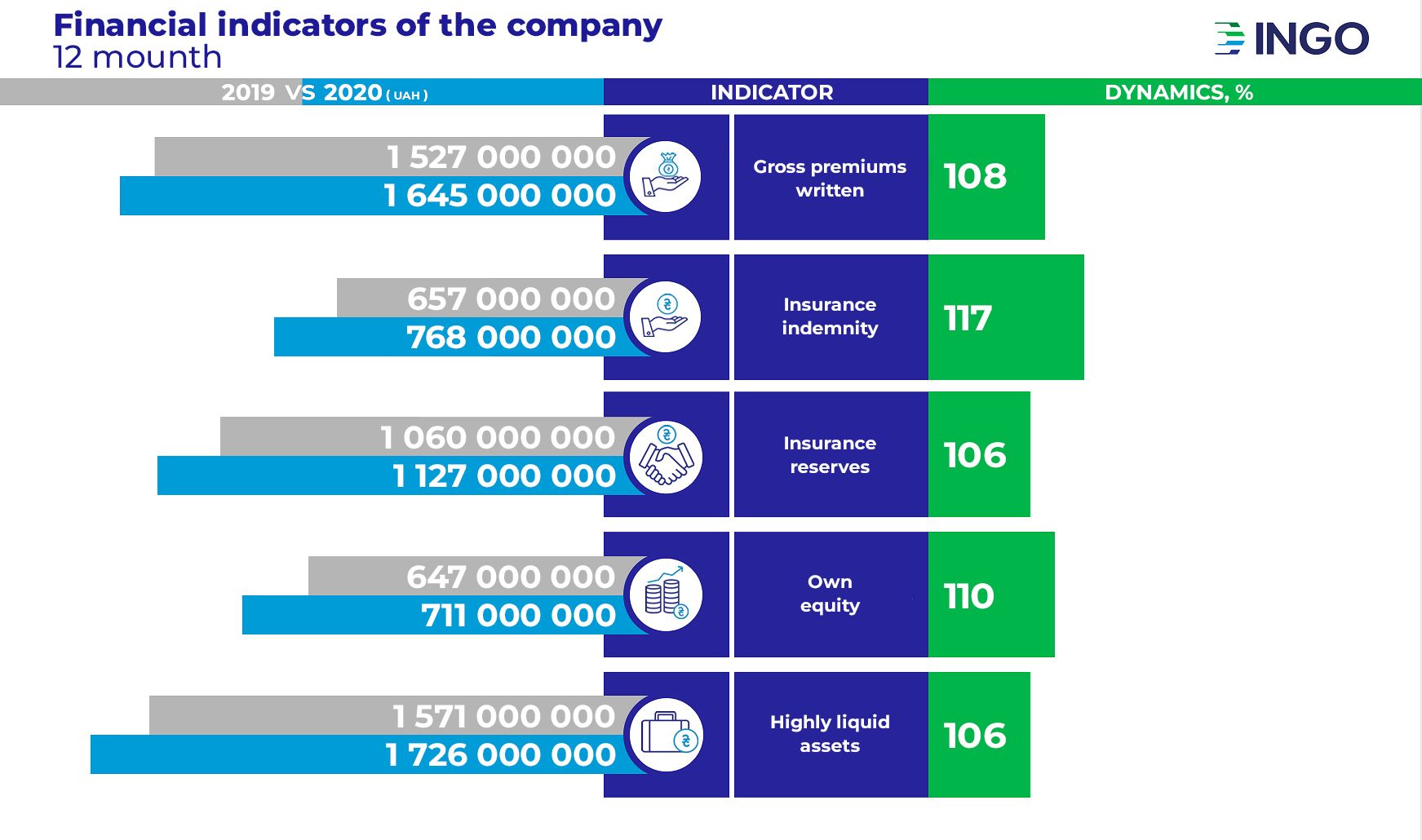

In 2020, Insurance Company “INGO” settled over 145 ths insured events and paid over UAH 768 mln under its liabilities to the clients, which exceeds this indicator by 17% compared to 2019.

At the same time, due to the rapid decline in social activity in the first half of 2020, the number of insured events decreased in all classes of insurance (-19%).

Due to the restrictions on the border crossing, the sales of ‘Green Card’ insurance and overseas travel insurance contracts significantly dropped.

In medicine, the demand for remote services is increasing, the number of visits to clinics has decreased. The current situation with COVID-19 has only increased the importance of health protection, so the insurance premiums and indemnities in the health insurance are steadily increasing. The volume of premiums increased by 33.7% compared to the last year.

The demand for new products in CASCO motor insurance was also growing, in particular the products with a variable cost. The total volume of premiums in the CASCO segment exceeded last year's figure by 3% after a temporary reduction in demand in Q1, 2020. There was no business decline in the segment of CTPLI (growth + 36%). The volume of premiums also increased in voluntary liability insurance (+ 5%).

"Last year, despite the high "turbulence" of external environment, the company continued to implement projects for improving its operational efficiency and creating the innovative environment. In 2020, we received above-plan financial results, implemented a series of business and IT projects," - said CEO of JSIC “INGO” Igor Gordiyenko.

According to him, the company plans to pursue a transformation strategy aimed at developing advanced analytics, creating a new range of products and services, distribution channels, as well as staff development and training.

In general, in 2020 JSIC “INGO” collected over UAH 1.6 billion in insurance premiums, which exceeds its indicators by 8% compared to the same period of 2019. The company's net profit amounted to about UAH 92 million.