Theft of a vehicle is one of the standard risks covered by a motor hull insurance policy. And one of the most popular, especially for expensive cars. However, it is impossible to purchase an insurance policy exclusively covering this risk. After all, loss statistics show that such a policy will cost as much as the one with the risk of an accident, or even more.

If your car is insured against the risk of theft, you can store it without worrying about additional parking lot security. The only requirement of the insurance company to the insured car is that it has at least one anti-theft device: mechanical or automatic. This can be, for example, a mechanical or electromechanical lock on the gearbox, an immobilizer, a vehicle search and detection complex, a car alarm with two-way GSM communication, etc. The installation of the latter will allow the car owner to receive an additional 50% reduction in the theft rate.

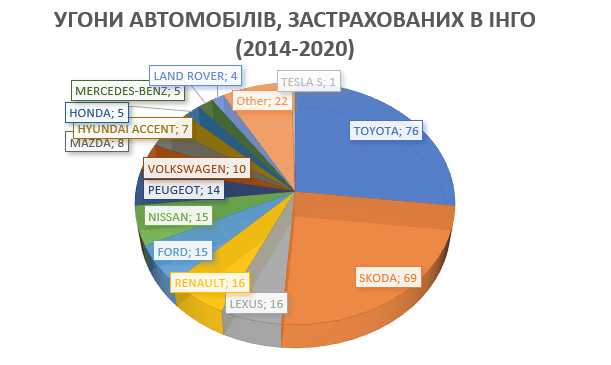

The peak of car theft cases among our insureds occurred in 2014-2015. 179 such cases were recorded during this time, most of which were in the temporarily occupied territories. In total, 311 vehicles insured by INGO were stolen in 2014-2020. More than 95% of them were cars, the rest were trucks, trailers, and buses.

The most frequent victims of thefts were owners of Toyota and Skoda cars (76 and 69 cars respectively). Moreover, the high number of Skoda cases was mainly recorded in 2014-2015, when the property of leasing companies in the occupied territories was significantly damaged.

The preferences of the hijackers are purely pragmatic. In fact, the statistics of thefts almost completely repeat the statistics of sales in the new and used car market. In this illegal way, thieves are trying to solve the issue of spare parts for the most popular brands and models. Recently, even individual body parts from cars imported from abroad (the so-called "Americans") have been stolen.

Of course, this affects the cost of insurance, as the loss ratio of this segment of cars is higher. Thus, the tariff for the risk of theft in the more unprofitable segment may increase by 0.5-1%.

Theinsurance indemnity for a stolen vehicle is made within the full sum insured (but not more than its actual market value at the time of the insured event), taking into account the deductible and depreciation for the period of the contract. That is, you will receive as much as you insured for. Therefore, at the insurance stage, you should make sure that the sum insured is not lower than the market value of the car. This will allow you to receive an adequate insurance payment. Also, keep in mind that for cars that have been in operation for more than 2 years, depreciation is taken into account, the annual rate of which is usually 10%. Pay attention to the deductible for the risk of theft (this is a separate indicator that differs from the deductible for the risk of damage). Usually, its size ranges from 0% to 10%, but the optimal price/coverage ratio is 5%.

In the event of a car theft, it is very important to strictly follow the insurance claim procedure. Of course, the driver may not remember the details of the insurance contract, which describes this procedure. But the only thing you need to know and do is to immediately notify the insurance company's contact center at the scene of the accident and register it with law enforcement agencies. After that, the contact center operator will help you navigate the next steps and tell you what exactly you need to do. What documents need to be collected to settle the case and within what time frame. The operator will remind you that you must submit both copies of the car keys and other details to the insurance company along with the documents.

In case of any questions, it is better to seek advice from the insurer once again, because violation of the procedure or failure to comply with it may result in a refusal to compensate for the damage. The insurance company may reduce the amount of the insurance payment by 20% if the car was not equipped with any anti-theft system at the time of the theft. And if the satellite system declared at the time of insurance was deactivated, the company may refuse to pay compensation at all. The technical passport (or the 2nd key) left in the stolen car is also a gross violation that falls into the category of reasons for refusal.

If the car owner has followed the rules and acted in accordance with the recommendations of the insurance company, there are usually no problems with insurance compensation. The insurance payment after theft is made no earlier than 2 months after the fact of the illegal seizure of the car is entered into the Unified Register of Pre-trial Investigations (URPI). After the compensation is paid, the ownership of the insured car in respect of which the payment was made is transferred to the insurance company.